Overview of valuation

“Living on our planet, today, requires a lot more imagination than we are made to have. We lack imagination and repress it in others.”

― Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

Introduction to Valuation

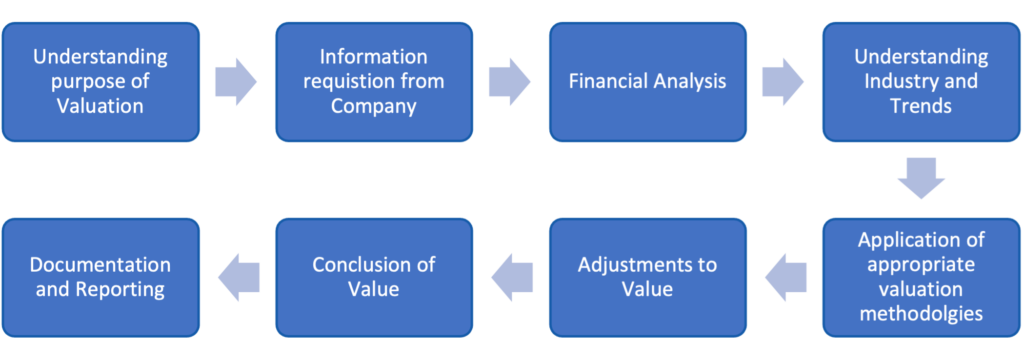

In layman’s term valuation is the process of analyzing the worth of an asset. To objectively derive the worth of an asset, it becomes pertinent to know what drives the value of an asset. Some assets are easier to value than others, the details of the valuation may vary from asset to asset, and the uncertainty associated with value estimates is different for different assets, but the core principles remain the same. For valuing financial assets, there are primarily three approaches for valuation which are explained in the article. Steps to follow for a valuation assignment –

Difference between Price and Value

As legendary investor, Warren Buffet, has once said, “Price is what you pay; value is what you get”

We often come across two types of statements –

- An investor does not pay more for an asset than it is worth

- The value lies in the eyes of the beholder and that any price can be justified if investors are willing to pay the price

Though the above statements may hold some ground while buying art/design where decisions are driven by sentiment or emotion, for financial assets – value is to be backed up by reality by estimating the cash flows an asset is expected to generate.

| Meaning | Price is the amount paid for the acquisition of a product / service | Value is the utility value/worth of product / service to a consumer |

| Meaning in short | What you pay | What you get |

| Determination | Determined from the customer’s or marketer’s perspective | Determined from the consumer’s perspective |

| Estimation | By policy pricing | By usefulness |

| Monetary Measurement | Yes | No |

| Price is the same for all | Value to each person varies |

Valuation Standards

Standards are the one that helps in bringing the uniformity in whole valuation exercise. The International Valuation Standards Council is the body responsible for setting the International Valuation Standards. It has issued various valuation standards. In India, ICAI has issued ICAI Valuation Standards 2018 as a benchmark for Valuation Practices applicable for Chartered Accountants for valuation of Securities and Financial Assets. The Valuation Standards have been issued by the ICAI to set up concepts, principles and procedures which are generally accepted internationally having regard to legal framework and practices prevalent in India. Valuation standards are introduced so that valuation is carried on basis of established principles. ICAI Valuation Standards covers the valuation of financial assets. In India, no other body has issued valuation standards. Some of the Registered Valuers Organization has adopted International Valuation Standards (IVS). The following Valuation Standards have been issued by ICAI (ICAI VS) and International Valuation Standards Council:

| ICAI Valuation Standards | International Valuation Standards |

1. ICAI VS 101 – Definitions 2. ICAI VS 102 – Valuation Bases 3. ICAI VS 103 – Valuation Approaches and Methods 4. ICAI VS 201 – Scope of Work, Analyses and Evaluation 5. ICAI VS 202 – Reporting and Documentation 6. ICAI VS 301 – Business Valuation 7. ICAI VS 302 – Intangible Assets 8. ICAI VS 303 – Financial Instruments | 1. IVS 101 Scope of Work 2. IVS 102 Investigations and Compliance 3. IVS 103 Reporting 4. IVS 104 Bases of Value 5. IVS 105 Valuation Approaches and Methods 6. IVS 200 Business and Business Interests 7. IVS 210 Intangible Assets 8. IVS 220 Non-Financial Liabilities 9. IVS 300 Plant and Equipment 10. IVS 400 Real Property Interests 11. IVS 410 Development Property 12. IVS 500 Financial Instruments |

Applicability of Indian Valuation Standards:

- These ICAI Valuation Standards will be applicable for all valuation engagements carried by Chartered Accountants on a mandatory basis under the Companies Act 2013.

- In respect of Valuation engagements under other Statutes like Income Tax, SEBI, FEMA, etc., it will be on a recommendatory basis for the members of the Institute. These Valuation Standards are effective for the valuation reports issued on or after 1st July 2018.

- These ICAI Valuation Standards will be effective till Valuation Standards are notified by the Central Government under Rule 18 of the Companies (Registered Valuers and Valuation) Rules, 2018. Till now no Standards has been notified by Central Government.

Purpose of Valuation

Valuation is required to be carried for various purposes. It can be classified broadly under 2 categories – Regulatory and non-regulatory. Valuations are usually carried out in India under various Indian laws-

| Company Law | Income Tax Law | SEBI | FEMA – RBI | Insolvency and Bankruptcy Code | Financial Reporting (Ind AS) | Others |

| Fresh issue of securities | Fresh issue of securities | Fresh issue of securities | Fresh issue of securities – FDI / ODI | CIRP | Purchase Price Allocation | US IRS 409A |

| Transfer of securities | Transfer of securities | Transfer of securities | Transfer of securities – FDI / ODI | Liquidation | Impairment tests | Succession Planning |

| Business Combination / Scheme of Arrangement | Sale of business under slump sale | Buyback of shares | Infusion of capital in LLP/partnership firm | Intangible Asset Valuation | Family and Business Disputes | |

| Issue of ESOP / sweat equity | Indirect transfer of shares | Delisting of shares | Financial Instruments | Self-assessment | ||

| Purchase Price Allocation | ESOP | Takeover Code | Valuation for Private Equity / Venture Capitalist | |||

| Who can perform Valuation? | ||||||

| Registered Valuer | Merchant Banker, Chartered Accountant | Registered Valuer, Chartered Accountant | Merchant Banker, Chartered Accountant | Registered Valuer | Registered Valuer | Merchant Banker, Chartered Accountant. Registered Valuer |

# Different professionals are required to undertake valuation depending upon the nature of the transaction and law. E.g., in the case of valuation under 11UA Chartered Accountant is not entitled to carry valuation using Discounting Cash Flow Method.

The same transaction may require different valuation reports under different laws and such valuation may be required to be carried by the different persons. E.g., Issue of shares – may require valuation by Chartered Accountant under FEMA, Registered Valuer under Companies Act and Merchant Banker under Income-tax Act.

Valuation Methodologies

- To determine fair value, a valuer may, therefore, use any of the approaches as per the generally / internationally accepted valuation methodologies which in its opinion are most appropriate based on the facts of each valuation.

- The internationally / generally accepted valuation methodologies have been discussed hereinafter, along with the reasons for the choice of the approach used based on the facts of the company.

Market Approach

Under this approach, the valuation is done based on the quoted market price of the company in case it is a publicly-traded company, or publicly traded comparable businesses/date is reviewed in order to identify a peer group similar to the subject company and then their multiples are applied to the entity being valued to determine the fair value. Types of Multiples widely used –

| Enterprise Value (EV) Multiples | Equity Multiples |

| EV/Revenue | P/E Ratio |

| EV/EBITDAR | Price / Book Ratio |

| EV/EBITDA | Dividend Yield |

| EV/Invested Capital | Price / Sales |

Commonly used Multiples by Sector –

| Multiple | Sector | Rationale / Comments |

| EV/Revenue | Various | Early-stage companies |

| EV/Subscriber | Various | Subscriber based businesses |

| EV/EBITDA | Various | Many Industrial and Consumer industries, but not Banks, Insurance, Oil & Gas and Real Estate |

| EV/EBITA | Various | Commonly used in several Media industry sub-sectors, Gaming, Chemicals and Bus & Rail Industries. |

| EV/EBITDAX | Oil & Gas | Excludes exploration expenses |

| EV/EBITDAR | Retail, Airlines | Used when there are significant rental and lease expenses incurred by business operations |

| EV/Reserves | Oil & Gas | Used when looking at Oil & Gas fields and companies heavily involved in upstream. Gives an indication of how much the field is worth on a per-barrel basis |

| EV/Capacity | Oil & Gas | For refiners, gives a value metric in terms of barrel per day of refining capacity |

| Market Cap / Book Value (“P/BV”) | Technology/ Banks/ Insurance | Used for the Semiconductor industry. Book value of equity is used since there can be significant earnings fluctuation in this sector. |

| EV/FFO | Real Estate | Principally used in the US |

| P/E | Various | Often using normalized cash earnings, excluding both exceptional items and goodwill amortization. |

| PEG ratio | High Tech, High Growth | Big differences in growth across companies. |

| (EV/EBITDA) / EBITDACAGR | High Growth | Used in Specialty Retail industry and when valuing emerging markets. |

When to use –

- Where the comparable asset is traded actively in the market

- Existence of recent transactions pertaining to the asset

- Existence of recent transactions pertaining to the comparable assets which is reliable

| Advantages | Limitations |

| Easy to use | Difficulty in identification of comparable |

| Less time consuming | Completely dependent on the selection of comparable |

| Easily understood by users | |

| Reflects current market trends |

Income Approach

The income Approach of valuation methods is based on the premise that the current value of any business is an output of future value that an investor can expect to receive by way of cash flows. It is an approach that converts maintainable or future amounts to a single current value. The fair value is determined based on the value indicated by current market expectations about those future amounts.

Discounted Cash Flow Method

The Discounted Cash Flow (“DCF”) method, an application of the Income Approach, is arguably one of the most recognized tools to determine the value of a business. The Discounted Cash Flow method indicates the Fair Value of a business based on the value of cash flows that the business is expected to generate in future. These cash flows are then discounted at a cost of capital that reflects the risks of the business and the capital structure of the entity.

When to use –

- Cash flows are currently positive

- Cash flows can be estimated with some reliability for future periods

| Advantages | Limitations |

| Based on performance expectations of the business | Only as good as the input assumptions |

| Not vulnerable to accounting conventions like depreciation and inventory valuation | Does not consider investment risk associated with opportunity cost |

Profit Earning Capacity Value (PECV) Method

It involves determining the future maintainable earning level of the entity from its normal operations. The valuer must give optimal weights to each financial year considering the profit trend and cyclical nature of business. This maintainable profit, considered on a post-tax basis, is then capitalized at a rate, which in the opinion of the valuer, combines an adequate expectation of reward from enterprise and risk, to arrive at the business value. The selection of the Capitalization Rate, the inverse of the Price Earning (‘PE’) Multiple, is a judgment of the valuer considering strengths and weaknesses of the company as well as market situations prevailing at the time of valuation.

When to use –

- The future cash flows cannot be reasonably estimated

- Historical earnings represent a fair business situation

| Advantages | Limitations |

| Easy to use | Based on historical earnings |

Asset Approach

A cost Approach is a valuation approach that reflects the amount that would be required currently to replace the service capacity of an asset (often referred to as current replacement cost). In certain situations, the historical cost of the asset may be considered by the valuer where it has been prescribed by the applicable regulation. The cost approach is based on the inherent assumption that the value of a business or investment can be determined based on the cost to rebuild or replace the business.

When to use –

- Specifically used for asset-intensive firms, holding companies, distressed entities

- Can be quickly recreated with substantially the same utility as the asset to be valued

- The liquidation value is to be determined

- Income approach and/or market approach cannot be used

| Advantages | Limitations |

| An easy and quick method of valuation | Ignores the amount, duration and timing of future economic benefit arising from the asset |

| Useful for asset-intensive assets | Does not consider the risk characteristics of the asset |

| Intangible assets, contingent liabilities are not accounted for | |

| Not the most preferred method for estimating enterprise value of going concerns |

Bias in Valuation

Sources of Bias

We rarely start a valuation assignment with a clean slate. We usually tend to form views on the value of an asset even before inputting the numbers in the models as a result of which our value conclusions tend to be closer to our biases. Hence, we already begin with a perception about the asset being valued. Some of the sources of bias are –

- Read something in the press / news (good or bad) about the company;

- Heard from an expert that it was under or overvalued

- Management discussions of performance

- Summaries of how many analysts are bullish and bearish about the stock

How to reduce biases

At the end of the day, valuation is not performed by analysts in a vacuum. These could be some ways to reduce biases –

- Reduction of institutional pressures

- De-link valuations from reward/punishment

- No pre-commitments

- Self-Awareness

- Honest reporting

Valuation is an Estimate – Imprecision and Uncertainties

- Undertaking a valuation is unique for every transaction and requires efforts, application of mind and thought for each assignment separately. Only guiding principles can be adopted and considered by the valuer while undertaking each assignment.

- ‘Value’ is an estimate of the value of a business or assets, arrived at by applying the valuation procedures appropriate for a valuation engagement and using professional judgment. Value for the same assets at the same point in time could differ from person to person based on each individual’s perception.

- Valuation by its very nature, cannot be regarded as an exact science and the conclusions arrived at in many cases will be subjective and dependent on the exercise of individual judgment. Given the same set of facts and using the same assumptions, expert opinions may differ due to the number of separate judgment decisions. A valuation cannot be judged by its precision. We can value a mature company with relatively few assumptions and be reasonably comfortable with the estimated value.

Causes of Uncertainties –

Certain uncertainties cannot be avoided during valuation. Since no one knows what the future holds, we make our best estimates with what information we have at the time of valuation.

- Estimation Uncertainty

- Firm-specific Uncertainty

- Macroeconomic Uncertainty

Responses to Uncertainties –

- The advantage of breaking down the uncertainties into the above categories gives us an idea of what we can control, what we can manage and what we can pass through into the valuation. The idea is not to be completely hopeless because of uncertainties but mitigates them.

- Simulations, Decision Trees and Sensitivity Analyses are tools that help us mitigate uncertainty but not eliminate it. The primary focus of the analysts should be on making their best estimates of firm-specific information and steer away from bringing in their views on macroeconomic variables.

Valuation Complexities

Valuation models have become complex over time majorly because of two reasons – computers have become more powerful and information is available in plenty along with ease of access to such information. More detailed and complex models mean more inputs for details to be built into the model which also results in chances of potential errors. Some of the Costs of Complexity are –

- Overload of Information – Contrary to popular belief, it’s not always true that more information leads to accurate valuations. Valuation models follow the ‘Garbage in – Garbage out’ principle meaning the quality of output is only as good as the quality of inputs.

- Black Box Syndrome – As the models are more complex nowadays, it is becoming more common that the valuation models are often looked at as the black box which gives out values by the input of certain pre-defined parameters.

- Big vs Small Assumptions – Complex models usually have sections for all types of inputs based on which the model is run. It is a common occurrence that the valuer fails to comprehend the complete impact of the input assumptions on the overall value.

Specific Valuation Methodologies

Apart from the valuation methodologies explained earlier, there are certain other valuation methodologies that are used to value certain specific items. A brief of these methods is explained as under –

Valuation of Intangibles

The most commonly used Income methods of Valuation of Intangible Assets are –

- Relief from Royalty Method

- Multiperiod Excess Earnings Method (MPEEM)

- With and Without Method (WWM)

Valuation of Startups

Apart from the above methods, some of the methods of Valuation of startups are –

- Berkus Method

- Scorecard Valuation Method

- Risk Factor Summation Method

- Venture Capital Method

Contingent Claim Valuation

A contingent claim or option is an asset that pays off only under certain contingencies – if the value of the underlying asset exceeds a pre-specified value for a call option, or is less than a pre-specified value for a put option. Option Pricing Models are mathematical models that use certain variables to calculate the theoretical value of an option.

Black-Scholes Model

The Black-Scholes model is the most widely used method of Option valuation. The Black-Scholes model makes certain assumptions:

- The option is European and can only be exercised at expiration.

- Markets are efficient (i.e., market movements cannot be predicted).

- There are no transaction costs in buying the option.

- The risk-free rate and volatility of the underlying are known and constant.

- The returns on the underlying are normally distributed.

Binomial Model

The binomial option pricing model is a model that is used to price options and is based on the concept of no-arbitrage. The assumptions in binomial option pricing models are as follows:

- There are only two possible prices for the underlying asset on the next day. From this assumption, this model has got its name as Binomial option pricing model (Bi means two)

- The two possible prices are the up-price and down-price

- The underlying asset does not pay any dividends

- The rate of interest (r) is constant throughout the life of the option

- Markets are frictionless i.e. there are no taxes and no transaction cost

- Investors are risk-neutral i.e. investors are indifferent towards risk

Monte Carlo Simulation Model

Monte Carlo methods are a class of computational algorithms that are based on repeated computation and random sampling. Since the option is priced under risk-neutral measure, the discount rate is the risk-free interest rate. In order to get a good estimate from simulation, the variance of the estimator should go to zero and thus the number of samples should go to infinity, which is computationally not feasible.

Adjustments in Valuation

- Discount for Lack of Marketability (DLOM) – DLOM is based on the premise that an asset that is readily marketable commands a higher value than an asset that requires a longer period / more efforts to be sold or an asset having a restriction on its ability to sell. An investor will always pay less for an illiquid asset when compared with a similar asset with higher liquidity.

- Control Premium and Discount for Lack of Control (DLOC) – Control Premium generally represents the amount paid by the acquirer for the benefits it would derive by controlling the acquiree’s assets and cash flows. In converse situations, DLOC would be applied to derive the value of minority shareholding from the value of control stake.

- Synergy – Synergy is a concept which indicates that the combining effect of two or more assets or group of assets and liabilities or two or more entities in terms of their value and benefits will be or is likely to be, greater than that of their individual values on a standalone basis. Synergy is a term that is most commonly used in the context of mergers and acquisitions.

Rules of Thumb:

Rule of Thumb for certain valuation assumptions and inputs –

- Risk-Free Rate – Risk-free rate is usually considered as 10-year Government Bond Yield or higher tenure Government Bond Yield.

- Illiquidity discount – As Prof. Damodaran suggests in his paper, illiquidity discount is usually applied in the range of 20-30%.

- Beta – In case of unavailability of listed comparable peer companies, beta is usually considered as 1.

- Terminal Growth Rate – Terminal growth rate for a company is usually considered slightly higher than the country’s GDP growth rate.

- For most companies, the Cost of Equity is usually higher than the Cost of Debt.

- Cash flows of mature companies are usually in an increasing trend.

Conclusion:

In the ultimate analysis, the valuation will have to involve the exercise of judicious discretion and judgment taking into account all the relevant factors. There will always be several factors. E.g. present and prospective competition, the yield on comparable securities and market sentiments, etc. which are not evident from the face of balance sheets but which will strongly influence the worth of a share. This concept is also recognised in judicial decisions. For example, Viscount Simon Bd in Gold Coast Selection Trust Ltd. vs. Humphrey reported in 30 TC 2019 (House of Lords) as quoted by the Supreme Court of India in the case reported in 176 ITR 417 as under:

“If the asset takes the form of fully paid shares, the valuation will take into account not only the terms of agreement but a number of other factors, such as prospective yield, marketability, the general outlook for the type of business of the company which has allotted the share, the result of a contemporary prospectus offering similar shares for subscription, the capital position of the company, so forth. There may also be an element of value in the fact that the holding of the shares gives control of the company. If the asset is difficult to value, but is nonetheless of a money value, the best valuation possible must be made. Valuation is art, not an exact science. Mathematical certainty is not demanded nor indeed is it possible.”

Copyright © Artoval Advisors LLP 2023 | All rights reserved.